Kenya National Chambers of Commerce and Industry (KNCCI) Busia branch is on spot over its inability to spur Business and attract investors in the county, despite the county government providing an enabling environment.

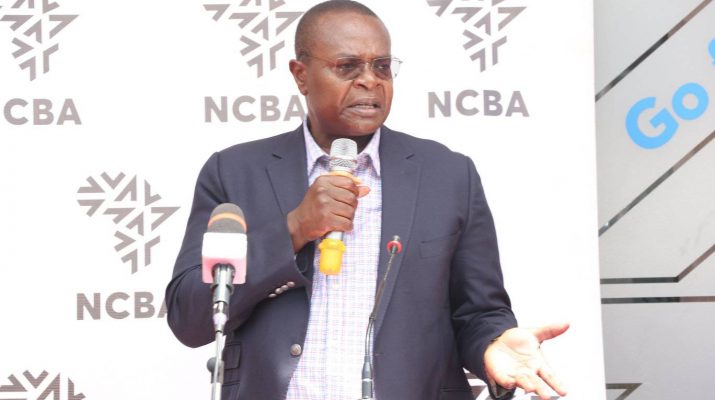

Speaking during the launch of the NCBA bank branch in Busia town, Busia governor Dr. Paul Otuoma urged the leadership of KNCCI that it was time for action and implementation of numerous business plans they have had over time to foster the growth and development of the town.

“Busia County is strategically situated serving as the gateway to Eastern and Central Africa, with a population of over 900,000, which proves to be an enabling environment for investors. Being an agricultural and cross trader hub, the county has great potential to become an East African economic hub,” said Otwoma.

On the other hand, NCBA group director of finance Mr. David Abwoga lauded the reception in Busia town with area residents having opened over 400 accounts within three months and investing over Sh100 million in terms of loans and assets.

The NCBA Busia branch is the 7th branch to be launched this year and 85th in the country. The bank also operates in Tanzania, Rwanda and Uganda with Kenya being its biggest market.

“NCBA Bank has today opened a new branch in Busia County as part of the bank’s strategic plan to expand its retail business aimed at taking services closer to customers. This brings to seven the total number of branches opened this year and 85 countrywide,” noted Abwoga.

He said the bank was targeting SMEs within the county by offering them solutions aimed at fixing the needs of the customers and businessmen, adding that the move to open a branch was necessitated by the fact that there are great opportunities for trade and investment presented by the county.

“The branch network enhances our ability to meet corporate and retail client needs by offering greater convenience of access and building trust, as client’s still rate access to a nearby branch as critical in selecting their bank of choice,” said Abwoga.

“We continue focusing on improving productivity and client experience through digitization of branch services to drive cost efficiencies and simplify processes. The strategy going forward is to convert branches into service centers for SMEs and corporate customers,” he added.

NCBA bank is the leading bank in asset financing and digital business, with a market share of more than 35 per cent in asset finance. The bank pioneered Mshwari and Fuliza.

Otuoma lauded the move by NCBA to invest in the county noted that it will improve the economic prospects of the people by offering employment and financial solutions to businessmen and farmers in the county.

“During my campaigns, I committed to supporting Small and Medium Enterprises (SMEs), the mama mboga, boda boda, industry among others. Our partnership with financial institutions will help us achieve this vision through friendly business loans,” said the Governor.

He also added that the new branch will help to make NCBA Bank a strategic partner in the economic growth and development of Busia County and help elevate the overall economic development in this region.

“Through this branch we will create employment opportunities for our constituents. This is of key importance to us as the creation of adequate, productive and sustainable employment continues to be the greatest economic challenge for Busia. The county has an unemployment rate of over 66.7 per cent. Our plan is to significantly reduce this number and we welcome partners who like to help us achieve this key milestone,” Otuoma said.

NCBA Group is a full-service banking group providing a broad range of financial products and services to corporate, institutional, SME and consumer banking customers.

NCBA Group operates a network of more than 100 branches in five countries including Kenya, Uganda, Tanzania, Rwanda, and Ivory Coast. Serving over 50 million customers, the NCBA Group is the largest banking group in Africa by customer numbers. NCBA Bank Kenya PLC is Kenya’s third largest bank by assets.

The Bank is set to play a key role in supporting Africa’s economic ambitions. The Bank is a market leader in Corporate Banking, Asset Finance and Digital Banking.