By Ashley Kariuki

Kenya has taken a bold step toward reinforcing its position as a premier financial destination with the signing of three high-impact investment agreements at the Kenya Investment Forum in London.

Held on the sidelines of the Africa Debate 2025, the event brought together public and private sector leaders to explore investment opportunities across the continent.

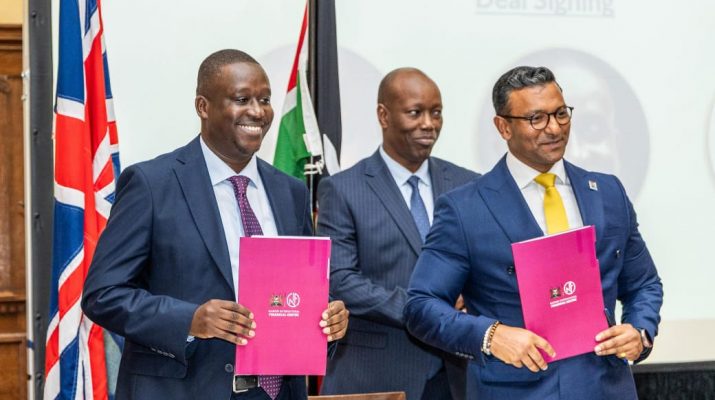

The Nairobi International Financial Centre Authority (NIFCA), under the National Treasury and led by CEO Daniel Mainda, signed strategic Memoranda of Understanding (MoUs) with Africa Speciality Risks (ASR), Bupa Group and the Africa Finance Corporation (AFC).

These partnerships are seen as a critical milestone in Kenya’s long-term vision to deepen its financial markets, attract foreign direct investment, and elevate Nairobi’s status as a globally competitive financial hub.

The signing ceremony was witnessed by Cabinet Secretary for Industry, Hon. Lee Kinyanjui, and Treasury CS Hon. FCPA John Mbadi Ng’ongo, both of whom underscored the government’s commitment to cross-sectoral collaboration and private capital mobilization.

The MoU with Africa Speciality Risks, represented by Chief Distribution Officer Amit Khilosia, will enhance Kenya’s investment readiness by leveraging ASR’s world-class underwriting expertise and global insurance capacity.

Through this partnership, ASR aims to de-risk up to $2 billion worth of investment exposure in Kenya, boosting investor confidence and strengthening the local insurance market.

Meanwhile, the agreement with Africa Finance Corporation, signed by Rita Babihuga-Nsanze, AFC’s Chief Economist and Director of Research and Strategy, will drive investment in infrastructure and green finance.

This aligns with Kenya’s national and regional sustainability goals, especially in climate-resilient development and strategic infrastructure projects.

A third agreement was formalised with Bupa Group, represented by Uditha Jayaratne, Managing Director of Bupa Africa.

This deal focuses on catalysing healthcare investment within the NIFC framework and developing high-quality health financing solutions. It reflects Kenya’s broader goal of integrating financial development with social resilience.

Together, the three partnerships signal a new era for Kenya’s financial services sector, one defined by innovation, resilience and strong global linkages.

With NIFCA leading the charge, Nairobi is well on its way to becoming a key financial gateway not just for East Africa, but for the entire continent.