By Okoth Otieno

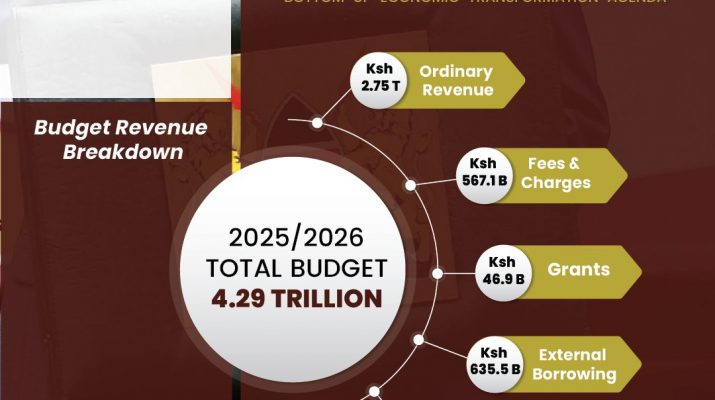

The National Treasury and Economic Planning has revealed the revenue breakdown for the 2025/2026 financial year, totalling Ksh. 4.29T. Presented before the National Assembly earlier today by CS John Mbadi, the budget aims to stimulate recovery, improve livelihoods, and foster job creation. However, the heavy reliance on borrowing has sparked both optimism and scepticism among citizens and analysts.

The budget revenue breakdown includes:

- Ordinary Revenue: Ksh. 2.75T

- Fees & Charges: Ksh. 567.1B

- Grants: Ksh. 45.9B

- External Borrowing: Ksh. 635.5B

- Domestic Borrowing: Ksh. 287.7B

Analysis of the Revenue Breakdown

Ordinary Revenue (64%):

-

- The largest component, Ksh. 2.75T comes from ordinary revenue (taxes, duties, etc.). It constitutes approximately 64% of the total. This aligns with the National Treasury’s strategy to bolster domestic revenue collection, with the reliance on ordinary revenue suggesting an emphasis on improving tax compliance and broadening the tax base.

Supplementary Revenue Sources (14.3%):

-

- Fees & Charges (13.2%): At Ksh. 567.1B, this category reflects income from government services and licenses. This is a modest but steady revenue stream, though its growth is limited compared to ordinary revenue.

- Grants (1.1%): The smallest component at Ksh. 45.9B indicates limited external grant support, possibly due to global economic constraints or a strategic shift towards self-reliance.

Borrowing Component (21.7%):

-

- Borrowing, both external (Ksh. 635.5B) and domestic (Ksh. 287.7B), totals Ksh. 923.2B Ksh, or about 21.7% of the budget revenue. This heavy reliance on debt echoes concerns raised, where Kenya’s debt servicing obligations are projected at Ksh. 1.1T for the coming year, fueled by non-concessional loans with high interest rates. The World Bank has previously cautioned that such borrowing can crowd out private investment, potentially undermining long-term economic resilience.

The World Bank projects Kenya’s GDP growth to recover to 4.9% on average from 2025-2027, driven by easing inflation and increased private consumption. The Treasury’s focus on ordinary revenue reflects efforts to bolster tax compliance amid past shortfalls.

However, the reliance on borrowing raises concerns, with the World Bank previously warning that such borrowing could crowd out private investment, potentially undermining long-term economic resilience.

As Kenya navigates this ambitious budget, all eyes will be on how the government balances economic recovery with public trust. And as the budget unfolds, its success will depend on transparent execution and addressing corruption.