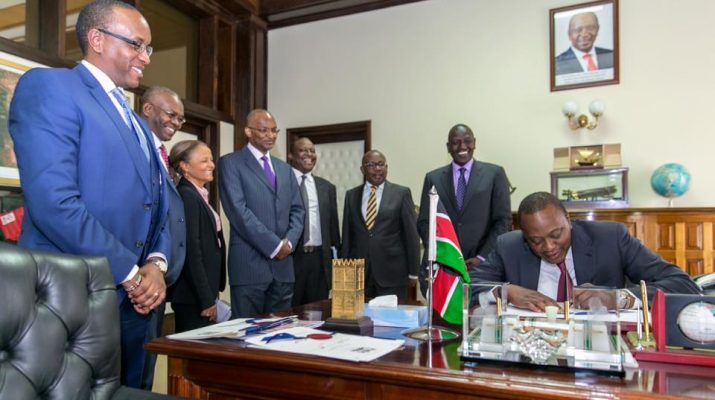

President Uhuru Kenyatta has signed the Banking (Amendment) Bill, on interest rates, into law. This has been confirmed by the State House Spokesperson Manoah Esipisu.

This means that all commercial banks have lost their bid to do away with interest rate controls, after President Uhuru Kenyatta signed the Banking Amendment Bill 2015 into law.

The law now limits the interest rates charged by banks to four percent of the Central Bank Rate. With the CBR currently at 10.5 percent, banks cannot charge higher than 14.5 percent as interest on credit.

“Upon weighing carefully all these considerations, on balance, I have assented to the Bill as presented to me. We will implement the new law, noting the difficulties that it would present, which include credit becoming unavailable to some consumers and the possible emergence of unregulated informal and exploitative The head of state said the government would closely monitor emerging difficulties especially those considered most vulnerable from credit access.e lending mechanisms,”” President Kenyatta said in a statement.

The is the third time that the National Assembly is attempting to reduce interest rates to affordable levels. In the previous two instances, dialogue and promises of change prevailed and banks avoided the introduction of these caps. In those instances, banks failed to live up to their promises and interest rates have continued to increase along with the spreads between the deposit and lending rates.

“Whilst doing so, my Government will also accelerate other reform measures necessary to reduce the cost of credit and thereby create the opportunities that will move our economy to greater prosperity,” the president stressed.

“We recognize that banks have done much in the last decade in terms of innovation and promoting financial inclusion and look to their doing more in that direction.

We also reiterate our commitment to free market policies in driving sustainable economic growth, to which we owe much of our success,” read the last part of the statement.